KNISO paperless digital purchasing ecosystem

Servicing the film and television industry

Available by request

KNISO offers bespoke solutions for your digital purchasing, approvals, and reporting protocols to create an intuitive and automated paperless ecosystem.

KNISO offers bespoke solutions for your digital purchasing, approvals, and reporting protocols to create an intuitive and automated paperless ecosystem.

Key Features

Access

New users onboarded in minutes, ready to spend with Apple Pay and Google Pay

Unlimited pre-paid physical and virtual cards

Accessible via web portal or mobile app (iOS & Android)

Supports international transactions

Hold multiple currencies or convert at POS

International Crew ID accepted

Usability

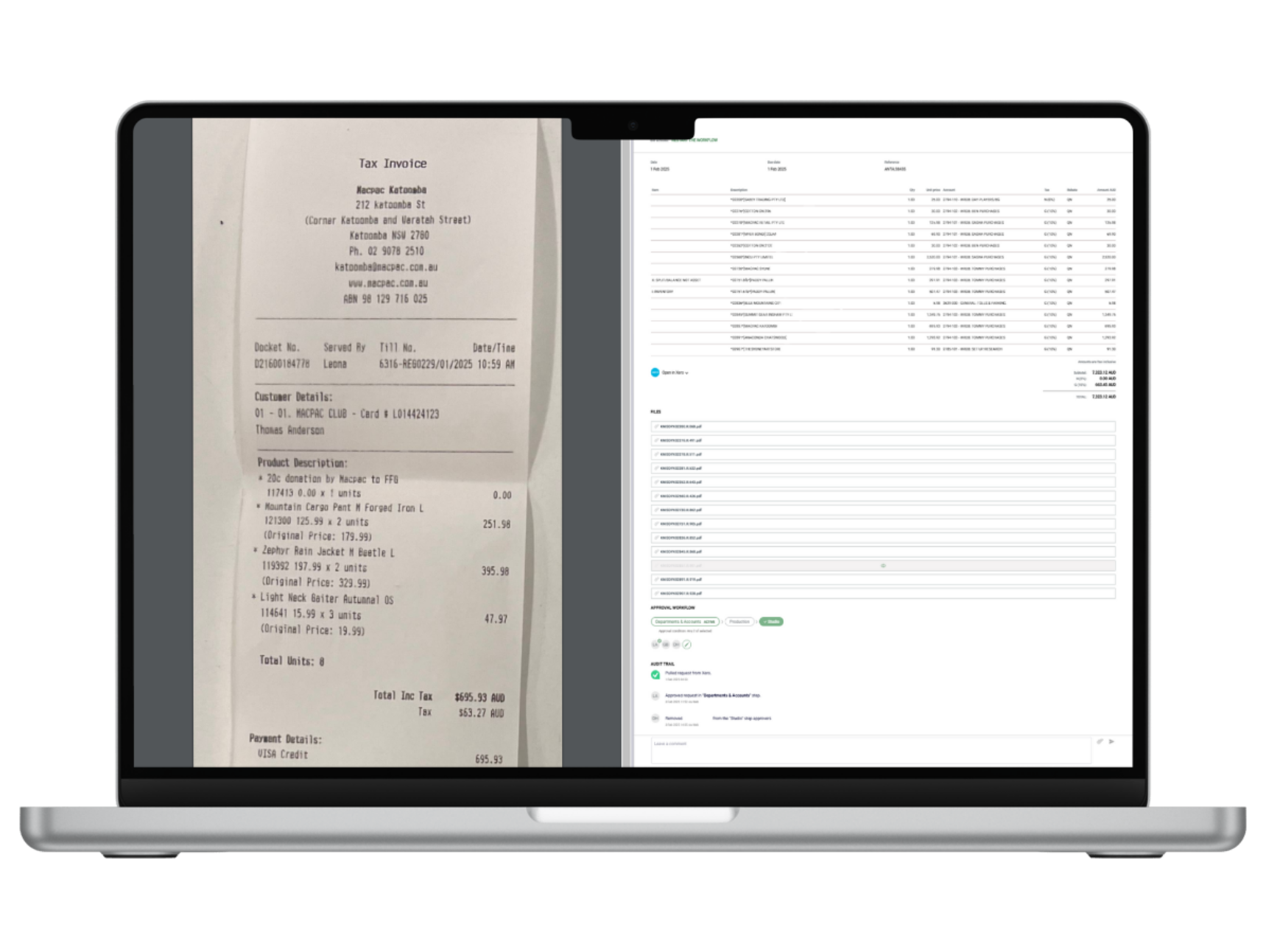

Real-time push notifications—no overnight delays, reconcile and submit instantly

Submit full receipts via mobile app—no desktop login required

Intuitive design minimizes keystrokes

Coordinators access all department transactions

User-specific coding restrictions

Easily split a transaction for coding or asset tagging

For Accounts

Paperless system enables remote work for accounting team

Auto-splits GST—no manual entry

Always reconciled—no need for statement checks

Specifically designed to track and reconciles accidental personal use with automated invoicing, reminders, and repayments

Problem receipts are discussed individually and don't hold up the envelope

Tracks rebates with preemptive merchant-based flagging

Intelligent Automation

Request a single use virtual card for spending over individual card limits

Auto-generated virtual cards upon approval-instantly ready to use

Transactions accepted by accounts are automatically grouped into an envelope for formal approvals

Selective enveloping groups transactions into applicable approval chains, so you approve only what you should

Supports complex approval chains and approver editing configurations

Side by side view and no scrolling to search for receipts

Control

Weekly reports generated in google sheets for upload into any accounting software

All spend can be included in the Cost Report, including up to the minute pending spend

Automatic warnings for late submission of receipts-cards are frozen when receipt is older than 30 Days

Instant reimbursement upon envelopes final approval

One click float bump to reinstate approved float limit as available funds

Bulk freeze cards and instantly adjust spending controls

KNISO offers more than just a card—providing an intuitive and automated post-purchase experience.

Partnered with Airwallex (VISA)

Over 150,000 companies around the world trust Airwallex.

Issue multi-currency Visa cards in 40+ countries

Airwallex is a principal member of Visa, allowing cardholders to transact securely in 170+ currencies worldwide.

Save on FX fees with multiple settlement currencies

Pay for purchases directly from your Airwallex multi-currency wallet, eliminating costly FX conversion fees.

0% international card transaction fees

Say goodbye to foreign transaction fees and other hidden charges, so you can reinvest every dollar back into growth.

Avoid the traditional need to lock-in funds per card

Airwallex issued cards don’t require you to lock in funds when requesting them – funds are sourced directly from your Airwallex Wallet.

Benefit from a range of card options

Support spend in multiple currencies with virtual cards, physical cards, Apple Pay, and Google Pay. Create cards for one-time or recurring use.

American Interchange fees and rewards programs explained

-

Interchange fees are transaction fees that merchants pay when accepting card payments, they can be added as a separate itemised transaction fee or embedded within the listed price.

The majority of these fees go to the card issuer to cover credit and fraud risks, with a portion allocated to the card network. Interchange fees are generally charged as a percentage of the transaction value plus a fixed fee.

-

Interchange rates vary based on several factors, such as the type of card, the country of card issuance, and whether the transaction happens online or in person. You can expect to pay up to 3.5% of the transaction value, plus a small fixed fee In the US, the average rate is about 2% of the purchase amount per transaction. Domestic transactions tend to have lower interchange rates than cross-border transactions due to lower processing risks.

For example, in a $150 purchase $0.30 might go to the acquiring bank, $0.20 to the credit card network, and $2.50 to the card issuer.

-

Credit card transactions typically incur higher fees than debit card transactions because credit card issuers use interchange fees to offset the risk associated with offering credit. Debit card payments carry less risk because they draw funds directly from the customer’s bank account. Premium credit cards with added perks and benefits often carry even higher rates.

-

Interchange fees vary significantly across the world. The US and Canada have some of the highest rates due to less regulation, while Australia has some of the lowest. Countries like China and Australia have capped interchange fees—China’s rates are 0.35% for debit cards and 0.45%-0.50% for credit cards. In Europe, regulations cap consumer credit card fees at 0.30% and debit card fees at 0.20%, leading to a more competitive fee structure.

-

Credit card companies use interchange fees to fund rewards programs such as cashback and air miles. In countries with high interchange fees, such as the US, many card providers offer cashback incentives to attract customers. While rewards programs can be beneficial to consumers, the cost is ultimately built into the prices charged by merchants.

-

In Australia, due to the already low interchange fees, no further cash back is possible.

KNISO/Airwallex can offer cashback on certain types of spending outside Australia, based on the Interchange fees charged by merchants.

If a production travels outside Australia cards offer a 1% cashback when used in America and up to 1% around the rest of the world.*

For US-based productions opening a KNISO/Airwallex account through a US entity, a rebate of 1%-1.5% is available for U.S. spending.*

Contact us for a comprehensive quote on KNISO’s Post-Purchase solutions.

*Minimum total spend thresholds apply

User Experiences